Invest by paying yourself first

Article Licenses: CA, DL, unknown, unknown, unknown

Advisor Licenses:

Compliant content provided by Adviceon® Media for educational purposes only.

Some people never pay themselves first.

After most people have paid for their necessities, there seems to be little left over for investing.

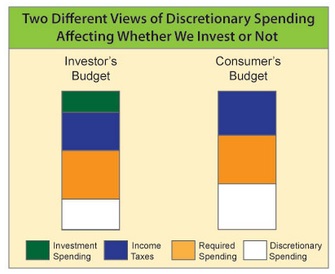

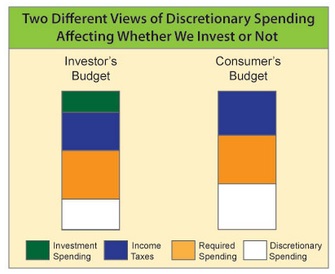

Determine your perspective on investing. Always spending and never investing is a serious dilemma often based on a certain mindset that can easily change for the better. Do you view yourself as a consumer or an investor?

Determine your perspective on investing. Always spending and never investing is a serious dilemma often based on a certain mindset that can easily change for the better. Do you view yourself as a consumer or an investor?

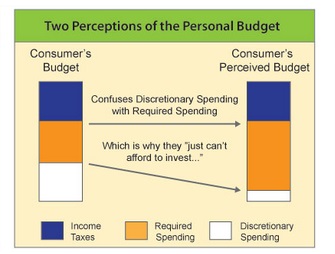

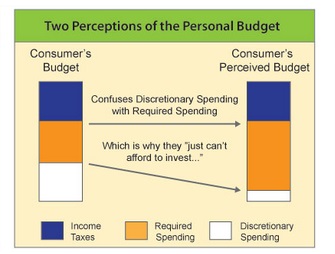

If you see yourself as a “consumer”, you may experience that there is never enough paycheck left at the end of the month for investing. However, is this caused by a lack of income or your own spending patterns? The first barrier to investing is a “perceived lack” of investment capital, often not reflecting reality. Unfortunately, what we think often becomes our reality.

Investors have personal discipline Conversely, “Investors” take an honest mathematical look at their expenses, separating discretionary income from what one needs to live on, knowing that impulsive buying decisions, even to purchase many small things on sale can add up.

This disciplined viewpoint allows them to have money to invest. Once paid, the first “consumption” decision can be to purchase an investment suitable to their goals and objectives. The rest of their paycheck is then spent with no worries on required consumption for the rest of the month.

Investors get good advice, and then act. Many people are impatient or confused when it comes to the science of investing. True “Investors” all have a key characteristic that makes for success — taking the right action with professional advisory assistance. They also understand that without experience and knowledge, investments decisions can be made in haste, and potentially destroy an otherwise good investment plan.

Publisher's Copyright & Legal Use Disclaimer

All articles are a legal copyright of Adviceon®Media and are for educational

purposes only. The particulars contained herein were obtained from sources

which we believe are reliable, but are not guaranteed by us and may be

incomplete. This website is not deemed to be used as a solicitation in a

jurisdiction where this representative is not registered. This content is not

intended to provide specific personalized advice, including, without

limitation, investment, insurance, financial, legal, accounting or tax

advice; and any reference to facts and data provided are from various sources

believed to be reliable, but we cannot guarantee they are complete or

accurate; and it is intended primarily for Canadian residents only, and the

information contained herein is subject to change without notice.

References in this website to third party goods or services should not be

regarded as an endorsement, offer or solicitation of these or any goods or

services. Always consult an appropriate professional regarding your particular

circumstances before making any financial decision. The information provided

is general in nature and should not be relied upon as a substitute for advice

in any specific situation. The publisher does not guarantee the accuracy and

will not be held liable in any way for any error, or omission, or any

financial decision.

Mutual Funds Disclaimer

Commissions, trailing commissions, management fees and expenses all may be

associated with mutual fund investment funds, including segregated fund

investments. Please read the fund summary information folder prospectus

before investing. Mutual Funds and/or Segregated Funds may not be

guaranteed, their market value changes daily and past performance is not

indicative of future results. The publisher does not guarantee the accuracy

and will not be held liable in any way for any error, or omission, or any

financial decision. Talk to your advisor before making any financial

decision. A description of the key features of the applicable individual

variable annuity contract or segregated fund is contained in the Information

Folder. Any amount that is allocated to a segregated fund is invested at the

risk of the contract holder and may increase or decrease in value. Product

features are subject to change.

Life Insurance and Segregated Funds Disclaimer

Life Insurance policies vary according to contract terms. Please read any

Life Insurance policy contract provided, or the segregated fund summary

information folder prospectus before the time of purchase. Full details of

coverage, including limitations and exclusions that apply, are set out in

the policy of insurance. Commissions, trailing commissions, management fees

and expenses may be associated with segregated fund investments which may

not be guaranteed and their market value changes daily and past performance

is not indicative of future results. A description of the key features of a

life insurance policy, a segregated fund; and any applicable individual

variable annuity contract is contained in information provided by the

company from which it is purchased. Talk to your advisor before making any

financial decision. For specific situations, advice should be obtained from

the appropriate legal, accounting, tax or other professional advisors. The

information provided is accurate to the best of our knowledge as of the date

of publication and is general in nature, intended for educational purposes

only, and should not be relied upon as a substitute for advice in any

specific situation. For specific situations, advice should be obtained from

the appropriate legal, accounting, tax or other professional advisors.

Rules and their interpretation may change, affecting the accuracy of the

information.

Determine your perspective on investing. Always spending and never investing is a serious dilemma often based on a certain mindset that can easily change for the better. Do you view yourself as a consumer or an investor?

Determine your perspective on investing. Always spending and never investing is a serious dilemma often based on a certain mindset that can easily change for the better. Do you view yourself as a consumer or an investor?